It is mandatory to link your AADHAAR with PAN (Permanant Account Number). Most importantly your income tax return would not be processed. You can not make a transaction above 50,000 without linking your AADHAAR and PAN.

Linking AADHAAR with PAN is a simple process. It takes less than two minutes to link online. Government has introduced various methods to link AADHAAR with PAN. So everyone should complete this process as soon as possible.

You can link AADHAAR with PAN by simple visiting incomtax e-filing website or by SMS.

What is the Importance of Linking PAN Card with Aadhar Card

- Your Income tax return would not be processed if your AADHAAR is not linked with PAN

- It helps in the case of multiple PAN in similar name.

- It simplifies the tax process

- All PAN cards will be deactivated if not linked with AADHAAR

How to Link AADHAAR with PAN Online

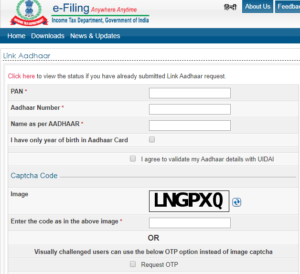

- visit the incomtax e-filing portal Click Here

- Enter your PAN and AADHAAR number ( Don’t worry It is safe an secure )

- Enter your Name. It should be as same as in your AADHAAR Card

- Enter the sequrity code (captcha)

- Click on the ‘Lnk Aadhaar’ Button

- A message will appear that “your Aadhaar is successfully linked with your PAN”

- Done

How to Link Aadhaar with PAN by Sending a SMS

- Send SMS in the format UIDPAN<12 Digit Aadhaar><10 Digit PAN> to567678 or 56161 from your registered mobile number.

- For example,If your Aadhaar number is 986960529895 and your PAN is ABCDE1234F, you have to type UIDPAN 986960529895 ABCDE1234F and send SMS to 567678 or 56161

Why i can’t link my Aadhaar with PAN

- If you can’t link you Aadhaar with PAN. Verify that your name on the Aadhaar card is same in your PAN. Eventhough your name is correct in the PAN Card. There may be some miss match in the incomtax portal.

- If the name in your Aadhar card is wrong, then you can apply for name change at your nearest Aadhaar help center.

- If PAN is mistaken, then you can change it online

Pingback: How To Check if my PAN Card is Linked with Aadhaar Card or not | iTechnowledge